While reading about the new Google initiative PAIR which is looking to humanize artificial intelligence (AI), I simply asked myself “how might we humanize mobile payments?”. I don’t want to say that m-payments are inhuman nowadays, however, could they become less tech focused and more “human centric”?

First of all, what does it mean “to humanize”? The goal of Google’s PAIR is to focus on the „human side“ of AI: the relationship between users and technology, the new applications it enables, and how to make it broadly inclusive. Looking on Google Search for the word it comes up with the following:

Another definition says: “to make (someone or something) seem gentler, kinder, or more appealing to people”. This is what I used to discuss in articles before with regards to innovation: make something easier, faster or better. But more precisely?

The same source gives another example further down: “Medical Definition of humanize – to render (cow’s milk) suitable for consumption by human babies”. To create an analogy one could say: “to render payments suitable for people’s everyday activities”.

It’s not about technology

To come back to Google who says: “Instead of viewing AI purely as a technology, what if we imagine it as a material to design with?”…. would turn into “instead of viewing payments as transactions, what if we imagine it as a material to design with?”.

Ealier this month Mastercard send some news that it wants to use AI to deliver an enhanced customer experience and security. Machine learning (one of the areas of AI) has been used to detect and prevent fraud for some time. For example, Paypal uses intelligent algorithms to detect if it’s me making a payment or if the behavior does not fit in with my habits (being better than rule based fraud detection and having already secured my purchases on various occasions for years where my cards were declined when being abroad). But I don’t want to discuss how AI can and already does improve security. What I am interested in is the “enhanced customer experience”.

How might we improve the customer experience?

I have been looking for examples how AI improves the customer experience (CX) in existing payment offerings. Of course, a declined payment is a very bad user experience and therefore the stated case is already very important. But what’s beyond? Everything CX but NOT fraud related. How might we humanize payments with a better customer experience taking advantage of artificial intelligence tech? What could that look like?

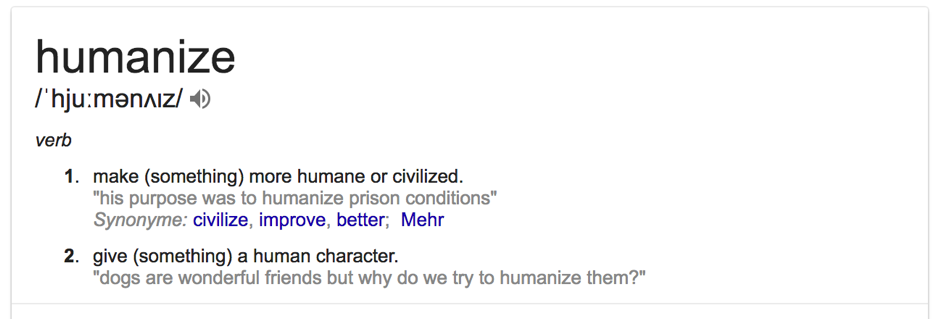

A while ago I saw the demonstration of “Finie” (“you can speak to it like it is a human in the room”), a voice controlled service that allows you to ask questions to your bank account such as: “I want to take my husband for dinner tonight. Is it ok if I spend 200 EUR on that?”. Finie will then figure out if that amount seems acceptable for me looking at my money and my spending habits. You may also ask Finie questions like “How much money did I spend on my business trip to Amsterdam last June?” while preparing your next trip or while doing expense analysis. Now one might say: this is banking not payments. Ah. However, me being a consumer, from my human point of view, its related to purchases and payments that I have made. Why separate them?

There are other voice controlled banking services such as German startup bank N26 allowing you to launch a bank transfer using Siri. Though it is using voice recognition and natural language processing (which are AI techs) it is not adding value from intelligent conclusions. Same for French startup Lydia allowing to send money to friends & colleagues via messenger app Slack. Or South African bank Absa allowing to initiate bank transfers via Facebook Messenger. And there are more bot and voice examples. By the way, voice is a very human trait and therefore one could say voice interaction humanizes payments.

Creating additional value – beyond replacing text by voice

Services in these examples are mostly providing a new interaction channel to a user sequence that is already existing. For example, a bank transfer is not triggered after login in a mobile app or online banking and the selection of the bank transfer function but triggered after a voice command. The result is the same but the experience of the sequence might be more liquid and faster. That also is value for the customer.

But is it possible to create additional value (something improved, something gentler or more appealing, something humanized,…) for the consumer combining the possibilities of artificial intelligence, the needs of people and differentiation factors for businesses? How can data enable such new things around payments? Should this be done by payment companies or rather other businesses?

Stay tuned, we will catch up on these questions…

Kommentar hinterlassen